When considering residential aged care in Australia, understanding the fees and funding options available is crucial. Contrary to a common misconception, selling the family home isn’t the only way to cover aged care accommodation costs.

In this guide, we’ll delve into the various fees associated with residential aged care and explore the funding avenues that might be accessible to older Australians.

Exploring Residential Aged Care Fees and Options

In Australia, Budgets for residential aged care are categorised into three segments:

1. Basic Daily Care Fee

This fee covers fundamental living costs within a residential aged care facility, encompassing essentials like food and laundry. The Basic Daily Care Fee is standardised for all residents, independent of their income or assets. It’s calculated at 85 percent of the standard full aged pension and is payable at regular intervals, often fortnightly or monthly.

2. Means-tested Care Fee

The Means-tested Care Fee is an ongoing charge that encompasses personal and clinical care expenses within the aged care residence. Its calculation takes into account income and assets, including annual income, marital status, home ownership, and household composition. This fee is determined through an assessment conducted by Centrelink or the Department of Veteran Affairs.

3. Accommodation Payment (RAD or DAP)

The method of payment for securing a room in a residential aged care facility involves either a Refundable Accommodation Deposit (RAD), a Daily Accommodation Payment (DAP), or a combination of both. The payment choice hinges on personal assets, income, and the cost of the selected room.

Refundable Accommodation Deposit (RAD)

A RAD function as an upfront payment akin to ‘buying’ the room. As the name implies, the amount paid is returned upon departure from the facility.

Daily Accommodation Payment (DAP)

Choosing a DAP is comparable to ‘renting’ a room without a deposit. Unlike the RAD, this periodic payment isn’t refundable. The DAP is calculated using the chosen room’s RAD amount multiplied by the government-set interest rate (MPIR) and divided by 365 days.

Extra Services Fee

Some facilities may charge extra fees for non-subsidized items like pay TV or supplementary services. Negotiation with Facility Management is often possible for these charges.

Navigating Costs for Residential Aged Care

This guide offers crucial insights into understanding fees, government assistance, and accessing appropriate residential aged care services.

1. Determining Fees and Charges

Fees and charges for both residential and home care are subject to quarterly updates. The latest schedule can be accessed on the Schedule of Fees and Charges for Residential and Home Care provided by Care360.

2. Care360s’ Assistance

Care360 offers a free service to families seeking suitable residential aged care options based on budget, location, care needs, and preferences. Their Placement Specialists are ready to aid in finding the right fit.

Funding Considerations for Homeowners

Owning a home is a significant achievement and a long-term investment. However, it often requires a substantial financial commitment, not only in terms of the initial purchase but also for ongoing maintenance, improvements, and unexpected expenses.

1. Impact of Home Ownership

For those who own a home valued over $193,219.20, it’s considered an asset that influences permanent residential aged care fees.

2. To Sell or Not to Sell?

When pondering selling the home to finance aged care, professional advice from a finance expert specialising in aged care planning is essential. Factors to discuss include accommodating the cost of aged care, ongoing care expenses, cash flow management, pension implications, tax considerations, and estate planning.

– Protected Person Status

A spouse residing in the home might qualify as a ‘protected person’, exempting the family home from asset consideration.

– Home Exemption for the Pension Assets Test

The family home remains exempt from the pension assets test for two years after moving into residential aged care.

– Financial Impact of Selling

Selling the home and yielding proceeds significantly exceeding the RAD cost can impact asset and income assessments, aged pension eligibility, and means-tested care fees.

3. Exploring Reverse Mortgages

A reverse mortgage allows accessing home equity without selling. Instead of borrowers making payments, lenders provide regular payments to borrowers.

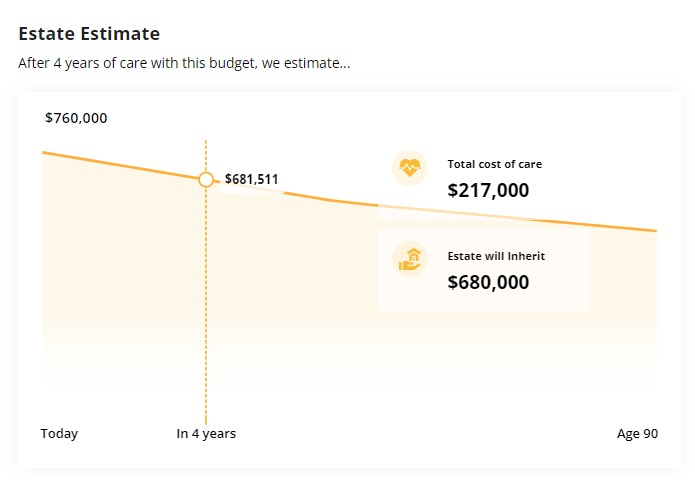

4. Defining Maximum Budget

Having a clear budget in mind is crucial, especially considering the average RAD in Australia is approximately $470,000. This budget should factor location, room features, and inclusions.

5. Finding the Right Facility

Care360 offers assistance in finding suitable residential aged care options. Through a personalised Options Report, they identify relevant vacancies for review, consideration, and comparison.

Understanding the intricacies of residential aged care fees and funding options is vital for older Australians and their families. By delving into the various fee components and seeking professional advice, individuals can make informed decisions about their accommodation and care needs in their later years. Care360 stands ready to provide guidance and support throughout this important process.

For more information on Care360, please visit our website www.care360.com.au and to stay up-to-date with our latest news follow us on Facebook & Instagram.